MoneyWeek is a weekly magazine that enables you to become a better-informed, smarter investor and enjoy the rewards of managing your money with confidence. Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor...

Cryptocurrencies go mainstream

Why has the Bank of England cut rates?

Gold slips back after tariff fright

Gulf markets go for growth

Viewpoint

■ The large gap in the copper market

MoneyWeek’s comprehensive guide to this week’s share tips

An American view

IPO watch

News

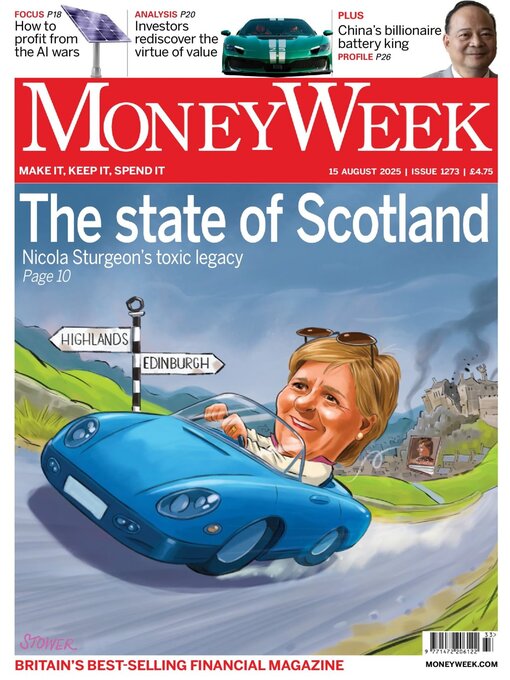

Nicola Sturgeon’s toxic legacy • On the left, she is seen as something of a political hero. That makes sense… but only if you exclude her actual record in office. Simon Wilson reports

Britain’s rust belt • More and more factories in the UK are closing, and the government doesn’t seem to care. What’s going on?

City talk

Rigging the earnings game • The number of US stocks beating estimates tells us only that guidance has deliberately been set too low

I wish I knew what market timing was, but I’m too embarrassed to ask

Guru watch • Charles Gave, co-founder, Gavekal

Best of the financial columnists

Money talks

We need a new growth gauge

The tyranny of gerontocracy

A defence of tourist taxes

EU plays a canny game in trade war

The goal of business is virtue, not profit • Serve your customers well and the profits will follow, according to a new book. It rarely works the other way around. Stuart Watkins reports

Buy the ammo-makers: how to find value in the AI wars • Big Tech is in a battle for supremacy over artificial intelligence. It’s hard to gauge who will win. Smart investors will back those firms that will profit whatever the outcome. Dan McEvoy reports

Investors rediscover the virtue of value • Growth investing, betting on rapidly expanding companies, has proved successful since 2008. But now the other main investment style seems to be coming back into fashion, says Katie Williams

The flaw in Terry Smith’s strategy • Fundsmith has invested in some excellent companies, but it has struggled to decide when to sell

Activist watch

Short positions... Saba targets try to tackle discounts

Ofgem smartens up its act • Consumers unhappy with smart meters may soon receive compensation

Trim your IHT bill with a trust

Pocket money... the colossal cost of frozen tax thresholds

How to access Lloyd’s • It’s hard for retail investors to get in on the action. Here are some of the ways to gain exposure

Europe’s forgotten stocks offer value, growth and strong cash flows • A professional investor tells us where he’d put his money: Jonathon Regis, co-portfolio manager, Developed Markets UCITS Strategy, Lansdowne Partners

CLASSIC Alex

China’s billionaire battery king • Robin Zeng, a pioneer in EV batteries, is vying with Li Ka-shing for the title of Hong Kong’s richest person. He is typical of a new kind of tycoon flourishing in Xi’s China. Jane Lewis reports

Trump’s nominee for Fed board will “let the doves fly”

Through the Alps to Lake Como • Louise Okafor travels from the Swiss Grand Resort Bad Ragaz to Villa Serbelloni, in Italy

Ferrari’s flying machine • The new F80 is a once-in-a-decade hypercar that will come to define the brand

Wine of the week: three very different Tuscan...

Issue 1273

Issue 1273

Issue 1272

Issue 1272

Issue 1271

Issue 1271

Issue 1270

Issue 1270

Issue 1269

Issue 1269

Issue 1268

Issue 1268

Issue 1267

Issue 1267

Issue 1266

Issue 1266

Issue 1265

Issue 1265

Issue 1264

Issue 1264

Issue 1263

Issue 1263

Issue 1261-1262

Issue 1261-1262

Issue 1260

Issue 1260

Issue 1259

Issue 1259

Issue 1258

Issue 1258

Issue 1257

Issue 1257

Issue 1256

Issue 1256

Issue 1255

Issue 1255

Issue 1254

Issue 1254

Issue 1253

Issue 1253

Issue 1252

Issue 1252

Issue 1251

Issue 1251

Issue 1250

Issue 1250

Issue 1249

Issue 1249